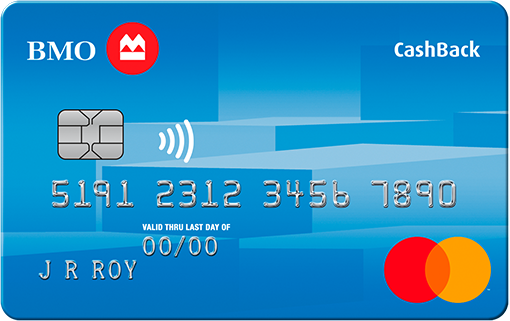

The BMO CashBack® Mastercard® is a popular credit card offered by the Bank of Montreal (BMO). It is designed to provide cardholders with cash back rewards on their everyday purchases, making it an attractive option for those who want to earn rewards while managing their finances.

One of the key features of the BMO CashBack® Mastercard® is its cash back program. Cardholders earn cash back on every purchase they make using the card, with different cash back rates for different spending categories. For instance, they may earn a higher percentage of cash back on gas and grocery purchases, while earning a lower percentage on other types of expenses. This allows cardholders to maximize their rewards by aligning their spending with the categories that offer higher cash back rates.

The cash back rewards earned with the BMO CashBack® Mastercard® are credited to the cardholder’s account automatically. They can be redeemed in various ways, such as applying them towards the outstanding balance on the card, depositing them into a BMO chequing or savings account, or even using them to make charitable donations. This flexibility gives cardholders the freedom to choose how they want to use their cash back rewards.

In addition to the cash back program, the BMO CashBack® Mastercard® offers a range of other benefits. These include features like purchase protection, extended warranty coverage, and identity theft protection. These benefits can provide peace of mind to cardholders, knowing that they are protected against certain risks and can receive additional support in case of unexpected events.

Another notable feature of the BMO CashBack® Mastercard® is its mobile banking capabilities. Cardholders can easily manage their account, view transactions, and make payments using BMO’s online and mobile banking platforms. This allows for convenient and efficient control over finances, making it easier to track expenses and stay on top of payments.

When it comes to fees and rates, the BMO CashBack® Mastercard® offers competitive terms. While specific fees may vary, cardholders can expect standard fees like an annual fee, interest charges on balances carried forward, and fees for cash advances and balance transfers. It’s important for potential cardholders to review the terms and conditions of the card to understand the complete fee structure.

As with any credit card, it is crucial for cardholders to use the BMO CashBack® Mastercard® responsibly. This means making payments on time and in full to avoid interest charges, keeping track of expenses to avoid overspending, and managing credit utilization to maintain a healthy credit score. Responsible card usage ensures that the benefits and rewards of the card outweigh any potential drawbacks.

Overall, the BMO CashBack® Mastercard® offers a solid option for individuals looking to earn cash back rewards on their everyday purchases. With its cash back program, additional benefits, and convenient banking features, it can be a valuable tool for maximizing rewards and managing finances effectively. However, as with any financial product, it is important for potential cardholders to carefully consider their individual needs and financial situation before applying.